The video is about #emotions in #investing #decisionmaking, and how to conquer #fear and #greed.

The #CanadianMoneyTalk channel concentrates on #Canadianinvesting and #personalfinance in Canada.

Canadian Investing and Personal Finance

The video is about #emotions in #investing #decisionmaking, and how to conquer #fear and #greed.

The #CanadianMoneyTalk channel concentrates on #Canadianinvesting and #personalfinance in Canada.

The video looks at the #BMO #survey of #Canadians that says we think we need $1.7 million for #retirement. I say you do not need that much, and do the analysis using the #fourpercentrule, looking at #CPP and #OAS.

The #CanadianMoneyTalk channel concentrates on #Canadianinvesting and #personalfinance in Canada.

The video examines #growth and #value #investing, and compares the two.

The #CanadianMoneyTalk channel concentrates on #Canadianinvesting and #personalfinance in Canada.

In this video I look at why #dividendstocks #outperform during #inflation and #volatility.

The #CanadianMoneyTalk channel concentrates on #Canadianinvesting and #personalfinance in Canada.

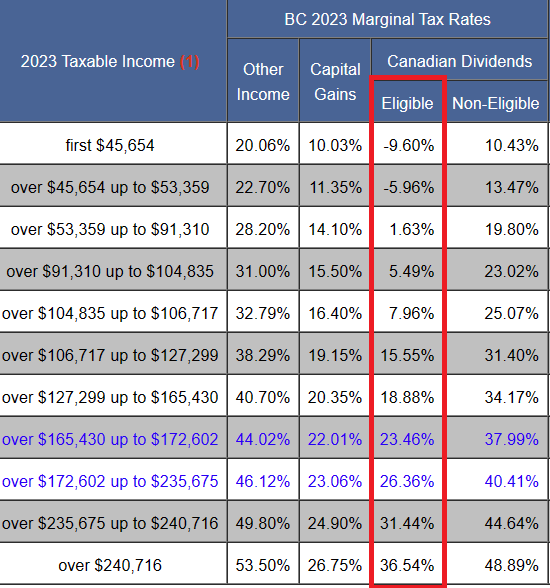

If you are using a non-registered (cash) account for your investing for cash flow and dividends, you may want to invest in Canadian Eligible Dividend payers. The dividends they pay get taxed very leniently, especially in lower tax brackets – check www.taxtips.ca for your province’s tax treatment. In BC, if I have no other income, the first approximately $50,000 of the dividends is not taxed at all, for example – see below. The government is encouraging us to buy Canadian. And the money you keep, not the money you earn, is important.

I compiled a list of Canadian dividend payers, and classified what types of dividends they pay. I tried to find a list online previously, and mine appears to be the first one. Even the CRA tells you to check the company’s Press Releases or website (Investor section). You should confirm the taxes on the dividends before buying the stock, by looking for “eligible”, “eligible dividends”, “enhanced” and the phrase section 89(14) of the Income Tax Act on the company’s site or in the Press Releases.

You also have to be an individual (other than select trusts) and be a Canadian Resident to qualify for the great tax treatment.

I look back at #canadian #realestate and look ahead at #2023.

The #CanadianMoneyTalk channel concentrates on #Canadianinvesting and #personalfinance in Canada.

The video is about #canada #productivity and #efficiency, which is lagging the #USA.

The #CanadianMoneyTalk channel concentrates on #Canadianinvesting and #personalfinance in Canada.

This video is about some actions to help with #taxes, #financialgoal and #Budget for the #2023 calendar year.

The #CanadianMoneyTalk channel concentrates on #Canadianinvesting and #personalfinance in Canada.

This video is about some actions to help with #taxes for the 2022 calendar and tax year. It includes #dollarcostaveraging and #rebalancing.

The #CanadianMoneyTalk channel concentrates on #Canadianinvesting and #personalfinance in Canada.

I went through my process of getting #OptionsIncome by selling #PutOptions for #Cashflow.

The #CanadianMoneyTalk channel concentrates on #Canadianinvesting and #personalfinance in Canada.