The video shows my #TFSA holdings, and I discuss #emergingmarkets #investing via #ETFs, and the changes I have made recently to my TFSA.

The #CanadianMoneyTalk channel concentrates on #Canadianinvesting and #personalfinance in Canada.

Canadian Investing and Personal Finance

The video shows my #TFSA holdings, and I discuss #emergingmarkets #investing via #ETFs, and the changes I have made recently to my TFSA.

The #CanadianMoneyTalk channel concentrates on #Canadianinvesting and #personalfinance in Canada.

I give an example of an #influencer who created something out of nothing by blowing a non-event out of proportion to cause #trading, fear, sensationalism and #views. I also discuss the #media.

The #CanadianMoneyTalk channel concentrates on #Canadianinvesting and #personalfinance in Canada.

I look at the #market, #marketnews, #marketupdates and overall #businessnews for the #week ending March 17, 2023.

The #CanadianMoneyTalk channel concentrates on #Canadianinvesting and #personalfinance in Canada.

The video argues that a young, increasing #population is the key to increasing #GDP and #economic #growth.

The #CanadianMoneyTalk channel concentrates on #Canadianinvesting and #personalfinance in Canada.

The video asks questions for your #retirement, such as how much you need to #save, #invest and whether to use a #RRSP or #TFSA.

The #CanadianMoneyTalk channel concentrates on #Canadianinvesting and #personalfinance in Canada.

The video is about #emotions in #investing #decisionmaking, and how to conquer #fear and #greed.

The #CanadianMoneyTalk channel concentrates on #Canadianinvesting and #personalfinance in Canada.

The video looks at the #BMO #survey of #Canadians that says we think we need $1.7 million for #retirement. I say you do not need that much, and do the analysis using the #fourpercentrule, looking at #CPP and #OAS.

The #CanadianMoneyTalk channel concentrates on #Canadianinvesting and #personalfinance in Canada.

The video examines #growth and #value #investing, and compares the two.

The #CanadianMoneyTalk channel concentrates on #Canadianinvesting and #personalfinance in Canada.

I went through my process of getting #OptionsIncome by selling #PutOptions for #Cashflow.

I use an options strategy to generate additional income, and buy cheap stocks. I sell Put options for immediate cash, and promise to buy the underlying stock at a price lower than it is today. I am selling insurance against the stock going down. If the stock goes up in price, the insurance (option) expires worthless in 6 weeks, which is my best case scenario, as I got the cash premium up front for nothing. If the stock goes below the price I promised to buy it for, I have to pay the price I promised, and get the stock. I only do this for stocks I own and like, and would buy anyway. I have the cash available to purchase the stock. If I didn’t have the money, I could buy the option back, generally at a loss.

The #CanadianMoneyTalk channel concentrates on #Canadianinvesting and #personalfinance in Canada.

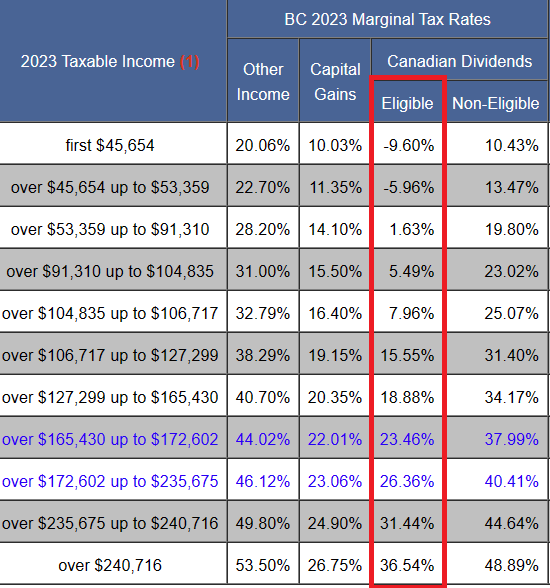

If you are using a non-registered (cash) account for your investing for cash flow and dividends, you may want to invest in Canadian Eligible Dividend payers. The dividends they pay get taxed very leniently, especially in lower tax brackets – check www.taxtips.ca for your province’s tax treatment. In BC, if I have no other income, the first approximately $50,000 of the dividends is not taxed at all, for example – see below. The government is encouraging us to buy Canadian. And the money you keep, not the money you earn, is important.

I compiled a list of Canadian dividend payers, and classified what types of dividends they pay. I tried to find a list online previously, and mine appears to be the first one. Even the CRA tells you to check the company’s Press Releases or website (Investor section). You should confirm the taxes on the dividends before buying the stock, by looking for “eligible”, “eligible dividends”, “enhanced” and the phrase section 89(14) of the Income Tax Act on the company’s site or in the Press Releases.

You also have to be an individual (other than select trusts) and be a Canadian Resident to qualify for the great tax treatment.