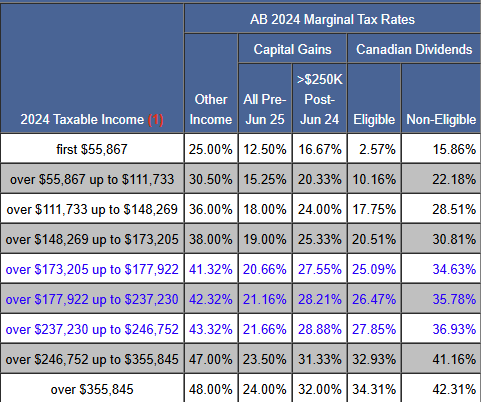

A #Morningstar article from January #2025 describes their latest #studies and #simulations from 2024 about the #sustainable #withdrawals from your #retirement portfolio, and I would like to share the results. Affluent #retirees are #living #longer, and traditional #pensions have declined in prevalence. Meanwhile, many retirees are working well past the traditional retirement age of 65. This video outlines what you need to know about retirement income planning. While there’s no one-size-fits-all plan, the #4% rule has been a popular approach. According to the 2024 data, how much can you spend in retirement so your #portfolio lasts 30 years?

The #CanadianMoneyTalk channel concentrates on #Canadianinvesting and #personalfinance in Canada.

Visit: http://www.canadianmoneytalk.ca

The Investing & Personal Finance Basics course is at https://canadianmoneytalk.ca/investing-personal-finance-basics-course/

The Advanced Investing: Stock Analysis Course is at https://canadianmoneytalk.ca/advanced-investing-stock-analysis-course/