The type of distribution(s) a stock pays affects how they get taxed in a non-registered or cash account. Check out the tax tables in www.taxtips.ca for your province on how distributions get taxed, but Canadian Eligible Dividends get taxed far less than interest or regular income, and less than capital gains in the lower tax brackets.

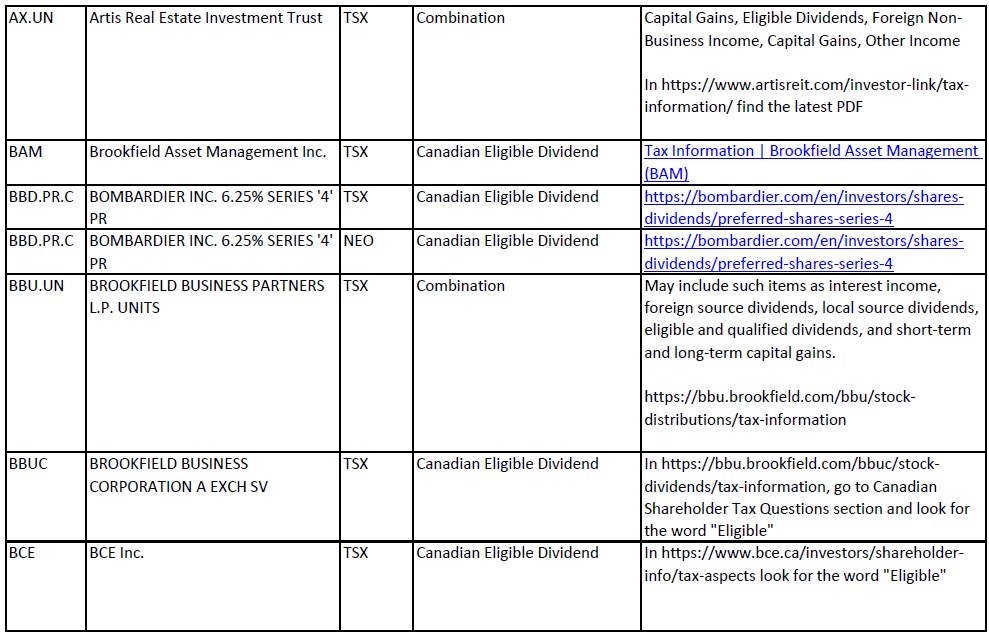

In November, 2025, I compiled and updated the distribution information list for 500+ Canadian-traded companies, and specified what kind of distributions it pays, for easy reference. If I found the information on the company’s website, I included the link, or instructions on how to find the information.

An example of one of the 75 pages is below.

Purchase to get access to the list

Purchase for $9.95 CAD with credit card to get access to the list, or if you prefer to e-transfer, please contact me to arrange this at canadianmoneytalk@gmail.com

Subscribe to get access to the list

Please confirm the information is correct prior to purchasing the stock. Note that most TSX and TSX-V stocks are on the NEO exchange as well, and same distribution types, so you can use the TSX or TSX-V company entry for a NEO company.

To check for yourself, you can usually find what company pays what kind of distributions in the company’s:

- Press Release for quarterly or annual earnings

- Press Release to announce upcoming dividends

- web site, usually the Investing or Investor Relations section, where it may be in the Dividends, Distribution, Stock, Documents or Tax sub-section, FAQ or the overall Investor handbook section

To confirm the company is paying Canadian Eligible Dividends:

Look for “eligible”, “eligible dividends”, “enhanced” and the phrase section 89(14) of the Income Tax Act.

The company needs to be Canadian based (headquartered), publicly traded, and designate/declare the dividends as eligible, notifying its shareholders as described above.

The company can trade on a US stock exchange, and/or pay dividends in USD, as long as the company is Canadian, to be able to pay Canadian Eligible Dividends.

You also need to be a Canadian Resident owner of the shares, who is an individual (other than certain trusts).