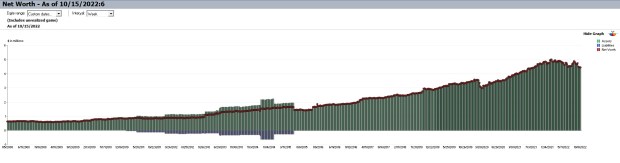

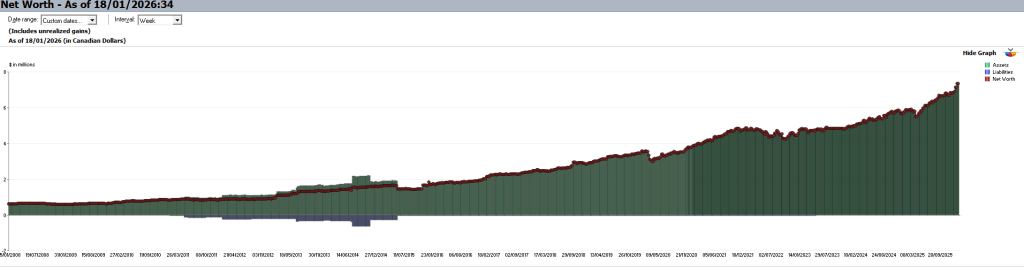

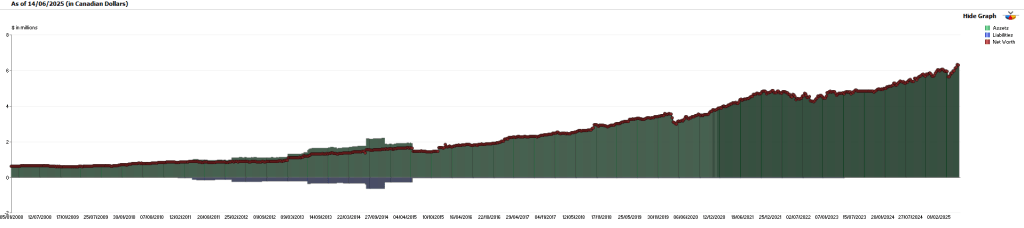

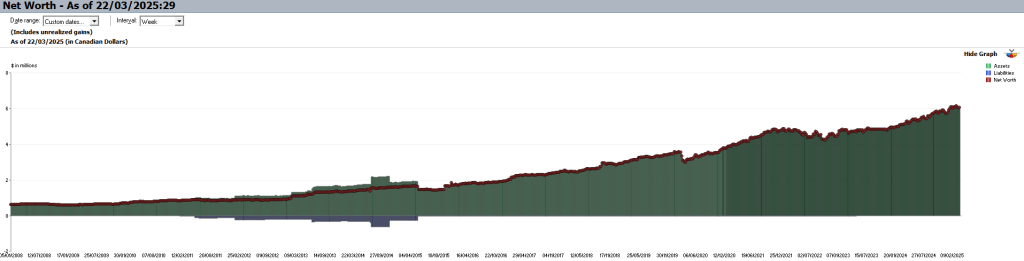

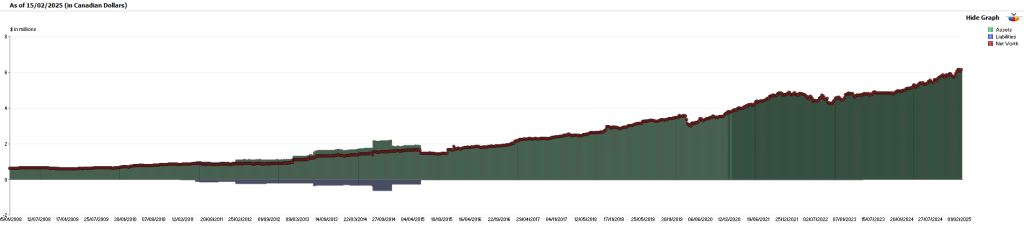

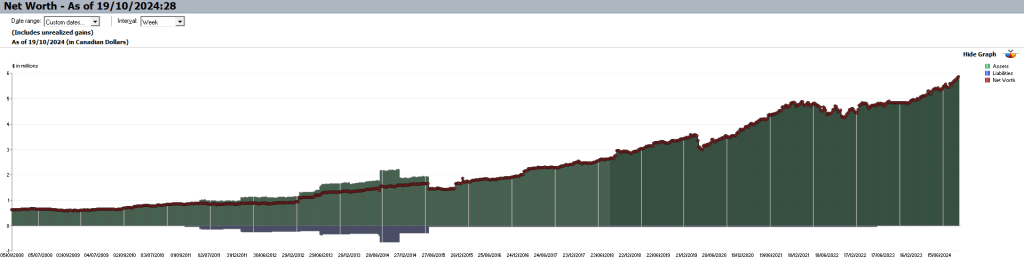

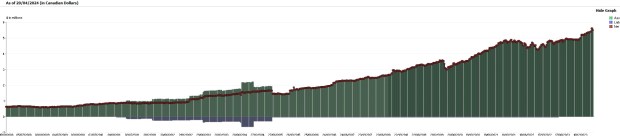

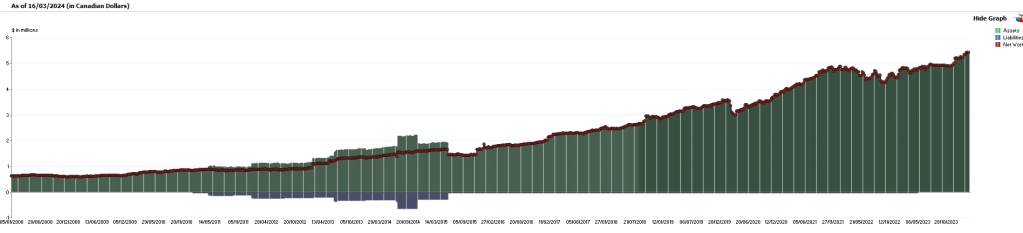

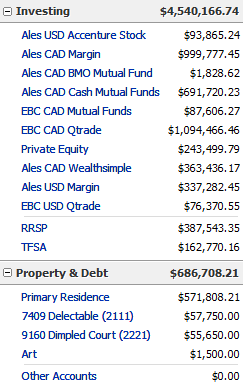

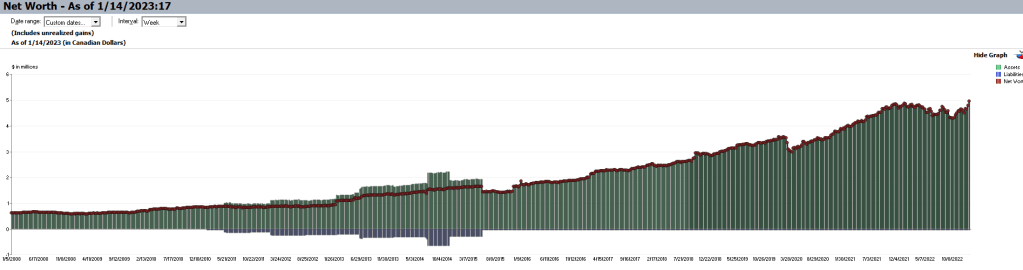

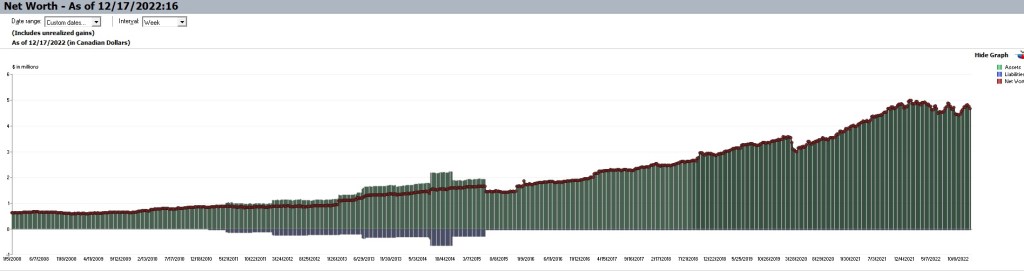

I track my net worth in my Intuit Quicken software, which is constantly updating my net worth as I enter my expenses, revenues and weekly stock prices – see My Portfolio for details. Net worth is important so I know how I am progressing towards my goals, whether I am going in the right direction, and whether I need to change anything.

Note: all numbers are before taxes, and US dollars are counted at par with Canadian dollars, so my net worth is actually higher than the graph shows.

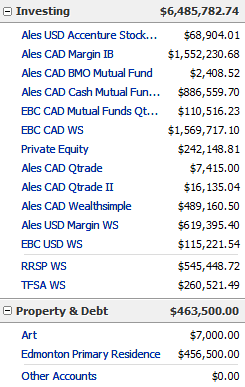

January 18, 2026: Following some minor volatility, but an upward trend, the net worth increased. The annual provincial primary residence value assessment also increased my house’s value, contributing to the higher net worth. Net Worth: 7,371K.

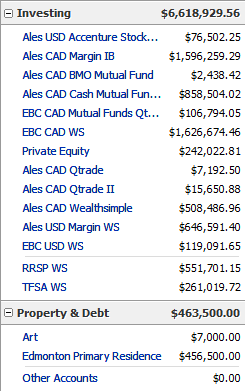

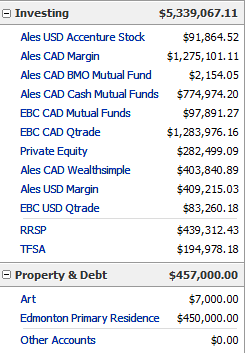

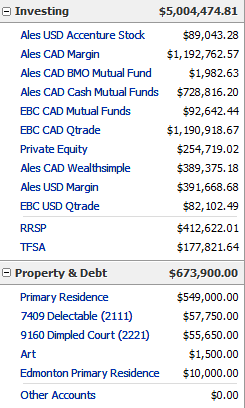

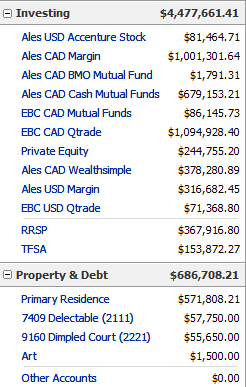

To give you a perspective on how the net worth is distributed, below are my trading accounts.

December 20, 2025: On a shallow stock market recovery, and the fears of an AI bubble somewhat going away, the net worth went up. Canadian banks, especially, contributed because they increased in value, and they are my major holdings. Net Worth 7,068K.

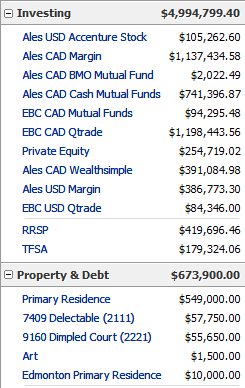

To give you a perspective on how the net worth is distributed, below are my trading accounts.

November 16, 2025: On stock volatility in Goeasy GSY, due to a bad quarterly report (second hit in two months), and in Northland Power NPI, which had a dividend cut, my net worth slipped from over 7 million once again to 6.9M and change. The markets are also showing fear of an AI market bubble, which is causing a sell-off in tech stock, and deflating the bubble. Net worth $6,949K.

To give you a perspective on how the net worth is distributed, below are my trading accounts.

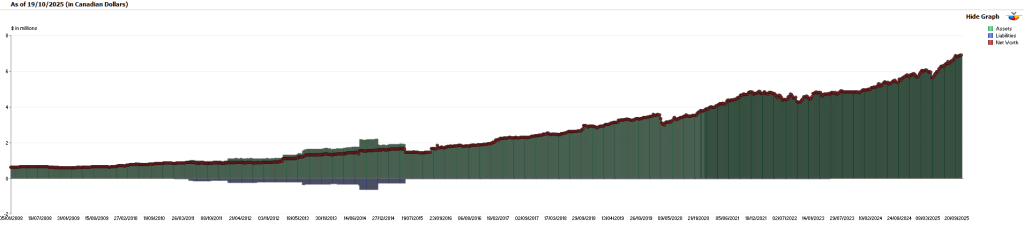

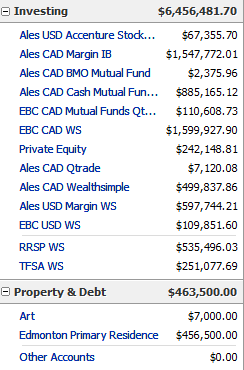

October 19, 2025: Markets continued upwards but showed volatility on trade war tensions between US and China. My net worth had gone to 7 million during the month before retreating. My biggest stock holding, Goeasy GSY, was hit by a shortseller, losing significant stock value. Net Worth: $6,929K.

To give you a perspective on how the net worth is distributed, below are my trading accounts.

September 21, 2025: The markets continue hitting new highs, especially as a rocky job market on both sides of the border has caused a cut in interest rates. The trade war continues and American exceptionalism appears to be taking a back seat with the US markets underperforming the rest of the world as money cycles out of the US. Net Worth: 6,945K

To give you a perspective on how the net worth is distributed, below are my trading accounts.

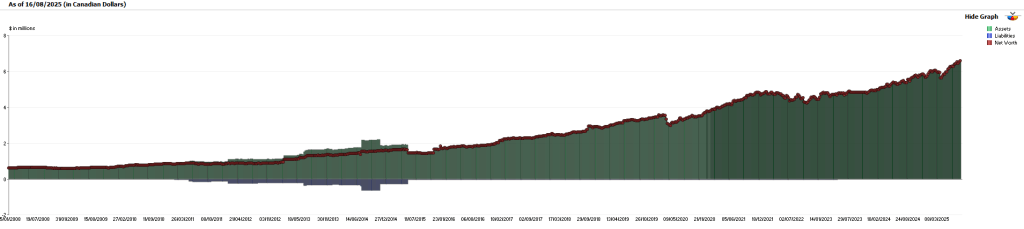

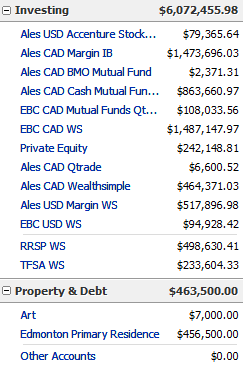

August 16, 2025: The markets are hitting all-time highs as expectations of lower interest rates and a slow resolution to the tariff crisis. Another all-time high in net worth has occurred, despite my spending 20K on a new house roof. Net Worth: 6,645K

To give you a perspective on how the net worth is distributed, below are my trading accounts.

July 19, 2025: The markets have reached new all-time highs as US tariffs were delayed once again, this time to August. My net worth is correspondingly at an all-time high. Net Worth: $6,521K

To give you a perspective on how the net worth is distributed, below are my trading accounts.

June 14, 2025: The markets have held up well in the last month as the US has backed off the tariff threats. Recent global tensions increased oil prices and caused oil companies to go up in price. I’m at a new net worth high. Net Worth: $6,341K

To give you a perspective on how the net worth is distributed, below are my trading accounts.

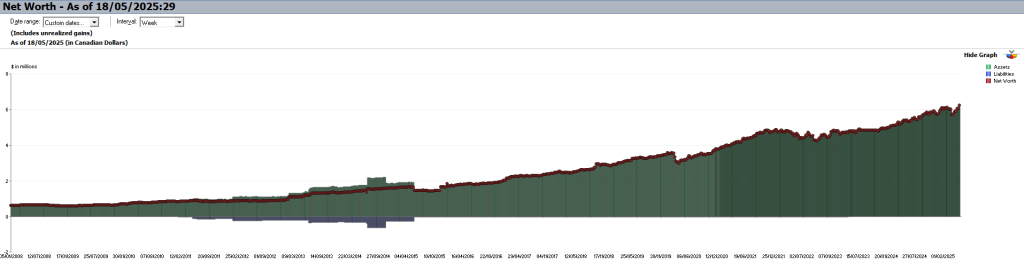

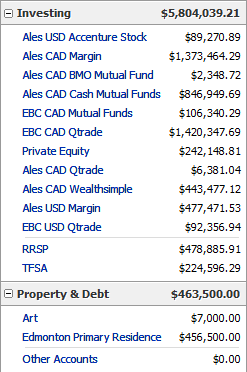

May 18, 2025: With 90-day pauses being put on the US tariffs, first excluding China, then including China, the markets recovered quickly, thinking the crisis over. Some general outlines of trade agreements also emerged. A new net worth high has been achieved, with the correction/bear market having come back to a new high. Net Worth: $6,274K

To give you a perspective on how the net worth is distributed, below are my trading accounts.

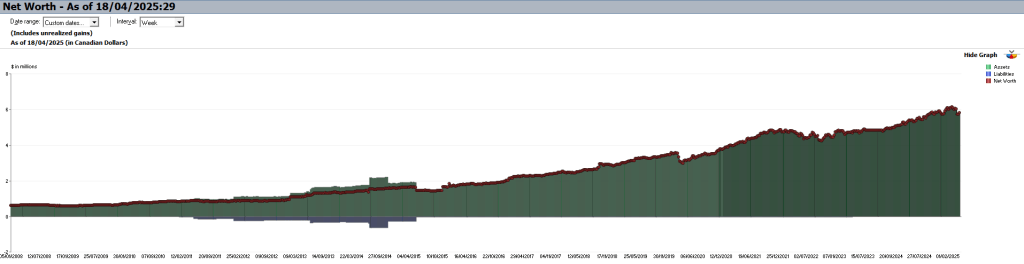

April 18, 2025: As further tariffs were put in place, along with counter tariffs from around the world, the markets sold off further, with huge volatility. There is a lot of negative sentiment of consumers, politicians and investors. The last-announced 90-day pause indicates the tariffs are a negotiating tactic, but it doesn’t make the investors feel any better. Net Worth: $5,869K

To give you a perspective on how the net worth is distributed, below are my trading accounts.

March 22, 2025: As tariffs came into effect, markets sold off, entering correction territory, with lots of volatility. April 2nd is supposed to contain the next set of tariffs. Net Worth: $6,093K

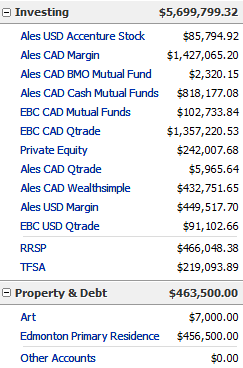

To give you a perspective on how the net worth is distributed, below are my trading accounts.

February 15, 2025: Markets perked up as tariffs were postponed, and Chinese stocks I own started taking off. I also received a significant tax refund for my corporation. Net Worth: $6,181K

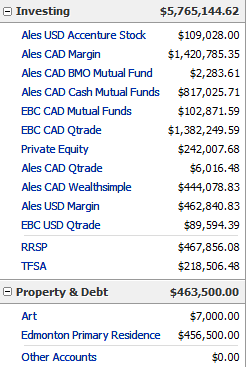

To give you a perspective on how the net worth is distributed, below are my trading accounts.

January 18, 2025: With worries about tariffs on foreign goods from Donald Trump, the market has come off and recovered. The tariffs are seen as a negotiation tactic, with only a small percentage priced into the markets. Net Worth: $6,089

To give you a perspective on how the net worth is distributed, below are my trading accounts.

December 14, 2024: There have been fluctuations in the market as inflation is picking up in the US, and we had Q3 earnings reports as well. I have been buying more BCE and TD as they came down, leading to some losses. Net Worth: $6,105K

To give you a perspective on how the net worth is distributed, below are my trading accounts.

November 16, 2024: The economy is softening with rising unemployment, and the US central bank is saying they may slow down interest rate cutting, causing some pullbacks in the markets. Net Worth: $6,081K

To give you a perspective on how the net worth is distributed, below are my trading accounts.

October 19, 2024: The interest rates and inflation are headed downwards on both sides of the border, helping the markets. Net Worth: 6,121K

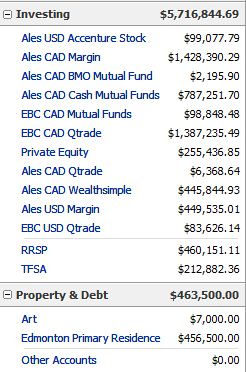

To give you a perspective on how the net worth is distributed, below are my trading accounts.

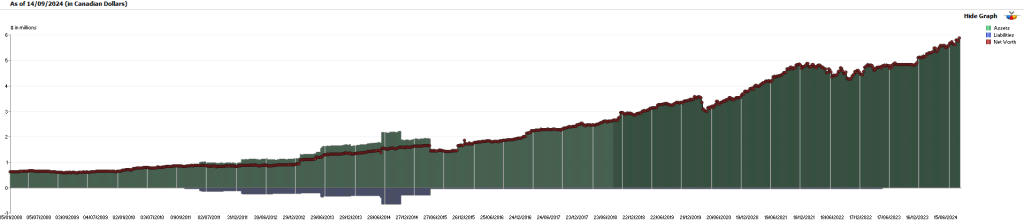

September 14, 2024: The market trended upwards, but with a lot of volatility, caused by the market guessing at the interest rate cuts, higher unemployment in the US, and the US election. Net Worth: 5,905K

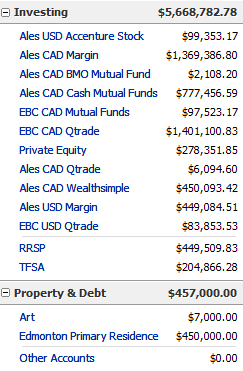

To give you a perspective on how the net worth is distributed, below are my trading accounts.

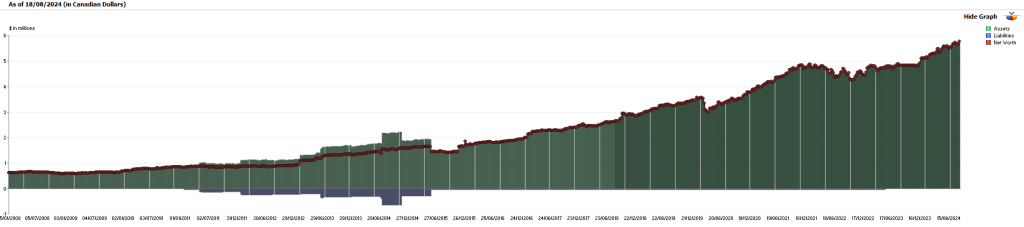

August 18, 2024: The portfolio took a trip down and then back up during the last 30 days as the Yen carry trade collapse caused a sell-off in the US markets, but after a week of sharp selling, the markets recovered. Some weak Q2 reporting and a slightly higher unemployment in the US caused additional worries, but the markets recovered as quickly as the fell. Net worth: 5,813K

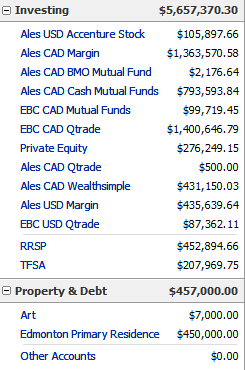

To give you a perspective on how the net worth is distributed, below are my trading accounts.

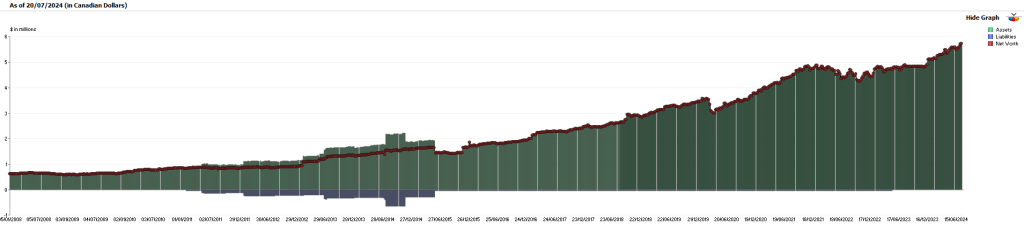

July 20, 2024: Rise in the markets thanks to the expected lower interest rates on lower inflation reads on both sides of the border brought up the stock portfolio. A possibility of US microchip exports to China being limited took some shine off the chip stocks, but an attempt at Trump increased his chance of a second term, removing an unknown.

All of my real estate and US-related transaction were completed since I moved to Edmonton and finalized that transaction in Quicken, as well as finally receiving my US tax refund, and thereby removing the US investment properties from my assets. Finally, I received a piece of art that I put a deposit down on 2.5 years ago, and put its market value into my asset list. Net Worth: 5,767K

To give you a perspective on how the net worth is distributed, below are my trading accounts.

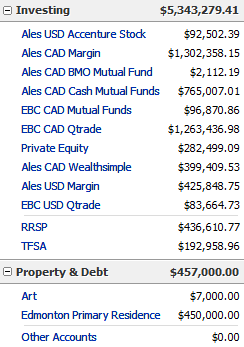

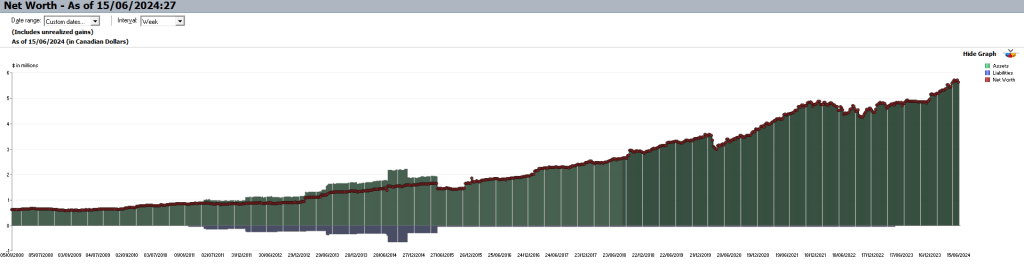

June 15, 2024: Volatility in the markets thanks to the expected lower interest rates and those rates not being cut despite lower inflation, led to lower stock prices overall. Net Worth: 5,652K

To give you a perspective on how the net worth is distributed, below are my trading accounts. In the Property & Debt section, Delectable and Dimpled are two US properties that have had US taxes withheld during their sale, and the IRS confirmer I am getting a 45K credit on my taxes. I also sold the Primary Residence and moved to in Edmonton, which have not yet been reflected in the numbers below.

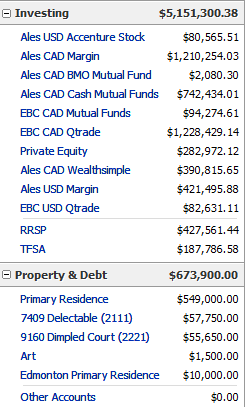

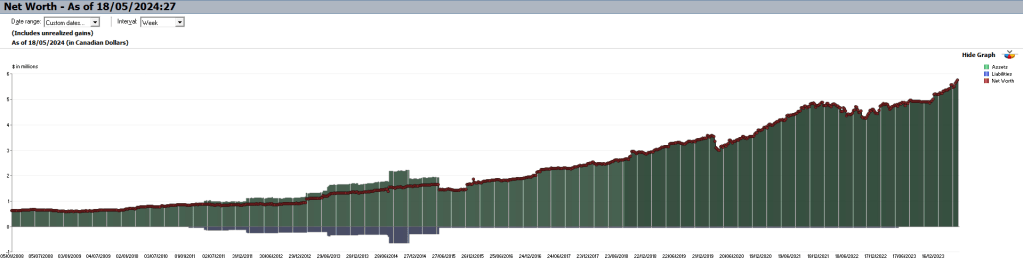

May 18, 2024: The markets, after some bad economic data, decided the central banks would bring interest rates down, and so all markets went up. Net Worth: $5,775K

To give you a perspective on how the net worth is distributed, below are my trading accounts. In the Property & Debt section, Delectable and Dimpled are two US properties that have had US taxes withheld during their sale, so I am expecting a credit on my taxes. I also put a deposit on a home I will be moving to in Edmonton.

April 20, 2024: The market came down recently because of higher-for-longer interest rates and the escalation of the conflict in the Middle East. The pull-back happened after a run-up at the end of March, so the net worth still came up since last month. Net Worth: $5,531K

To give you a perspective on how the net worth is distributed, below are my trading accounts. In the Property & Debt section, Delectable and Dimpled are two US properties that have had US taxes withheld during their sale, so I am expecting a credit on my taxes. I also put a deposit on a home I will be moving to in Edmonton.

March 16, 2024: The market largely treaded water over the last month. Dividends still came in, and there was a small capital appreciation. Net Worth: 5,440K.

To give you a perspective on how the net worth is distributed, below are my trading accounts. In the Property & Debt section, Delectable and Dimpled are two US properties that have had US taxes withheld during their sale, so I am expecting a credit on my taxes. I also put a deposit on a home I will be moving to in Edmonton.

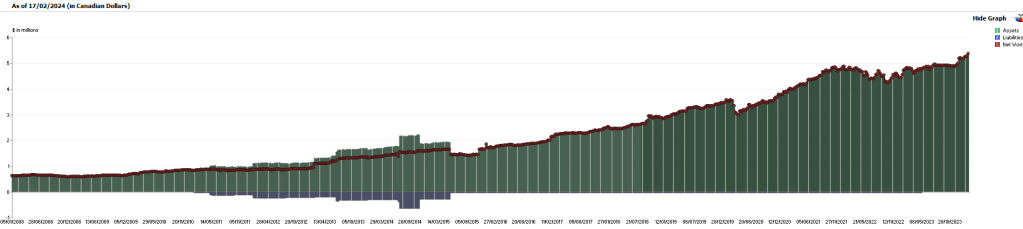

February 17, 2024: Despite some persistent inflation, a good earnings season for some big positions in my portfolio (Goeasy and Manulife) really made a difference. Net Worth: 5,401K.

To give you a perspective on how the net worth is distributed, below are my trading accounts. In the Property & Debt section, Delectable and Dimpled are two US properties that have had US taxes withheld during their sale, so I am expecting a credit on my taxes.

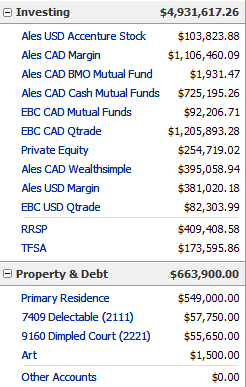

January 20, 2024: The markets stayed mostly flat for the last month, with a bit of upside. This also made me happy for my dividend payers. Net worth: $5,255K.

To give you a perspective on how the net worth is distributed, below are my trading accounts. In the Property & Debt section, Delectable and Dimpled are two US properties that have had US taxes withheld during their sale, so I am expecting a credit on my taxes.

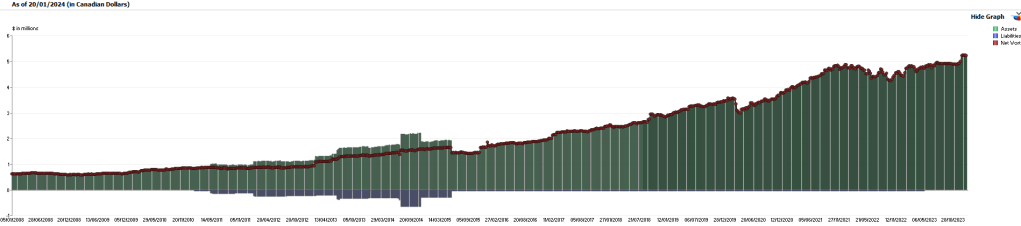

December 16, 2023: With the US central bank hinting at interest rate cuts coming in 2024, the markets took off in December. Net Worth: $5,226K.

To give you a perspective on how the net worth is distributed, below are my trading accounts. In the Property & Debt section, Delectable and Dimpled are two US properties that have had US taxes withheld during their sale, so I am expecting a credit on my taxes.

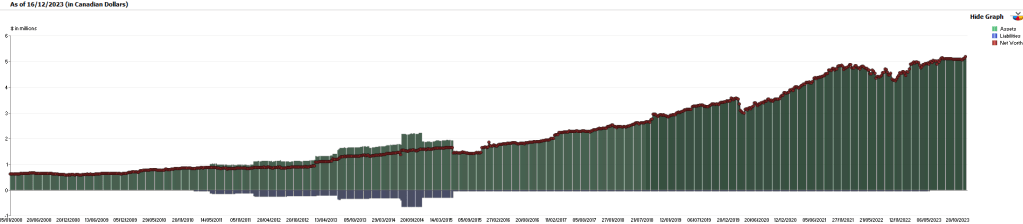

November 25, 2023: The last 3 months I was traveling, and during that the time portfolio initially lost about 6% because the markets realized the interest rates would be higher for longer, slowing down the economy. The losses were recovered with a 10% uptrend toward the end of the period as inflation continued downwards, and Canadian job market slowed, making investors think the interest rates stopping going upwards and may go down in 2024. Net Worth: $5100K

To give you a perspective on how the net worth is distributed, below are my trading accounts. In the Property & Debt section, Delectable and Dimpled are two US properties that have had US taxes withheld during their sale, so I am expecting a credit on my taxes.

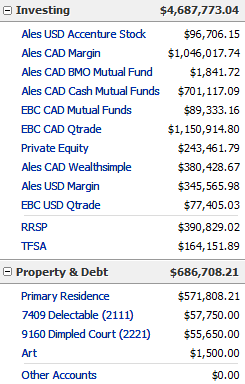

July 15, 2023: The month had a lot of volatility and ended higher because inflation has really come down, and the rate hikes are just about over. A new high net worth has been reached. Net worth: $5,137K

To give you a perspective on how the net worth is distributed, below are my trading accounts. In the Property & Debt section, Delectable and Dimpled are two US properties that have had US taxes withheld during their sale, so I am expecting a credit on my taxes.

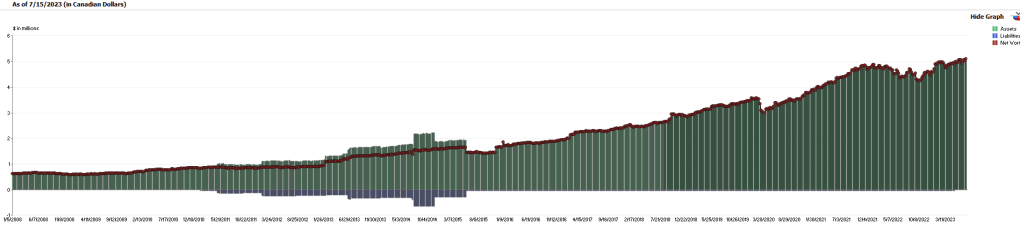

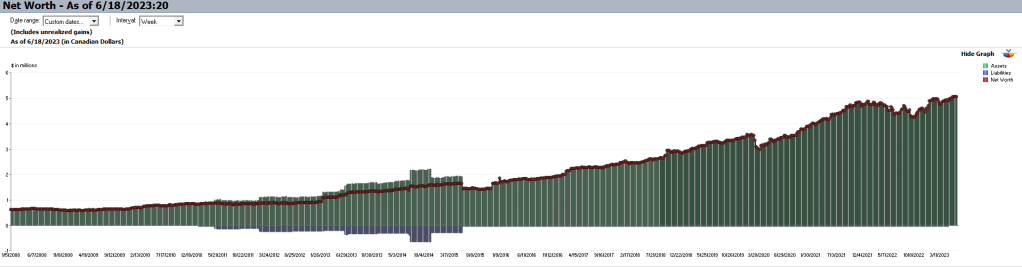

June 18, 2023: The month was mostly uneventful, as US stock appreciation made up for small losses on the TSX. Net Worth: 5,093K

To give you a perspective on how the net worth is distributed, below are my trading accounts. In the Property & Debt section, Delectable and Dimpled are two US properties that have had US taxes withheld during their sale, so I am expecting a credit on my taxes.

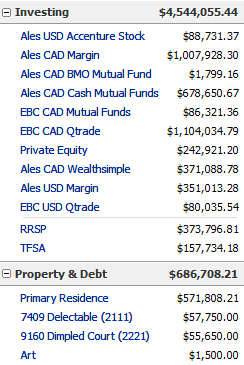

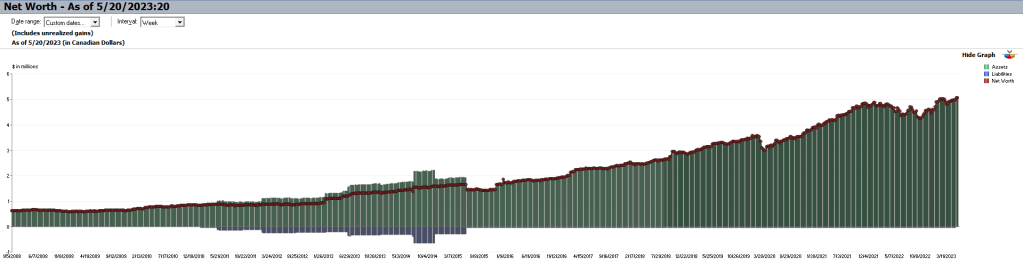

May 20, 2023: As inflation eases and interest rate hikes slow or stop, the markets respond upwards. A new all-time high net worth was reached. Net Worth: $5,100K

To give you a perspective on how the net worth is distributed, below are my trading accounts. In the Property & Debt section, Delectable and Dimpled are two US properties that have had US taxes withheld during their sale, so I am expecting a credit on my taxes.

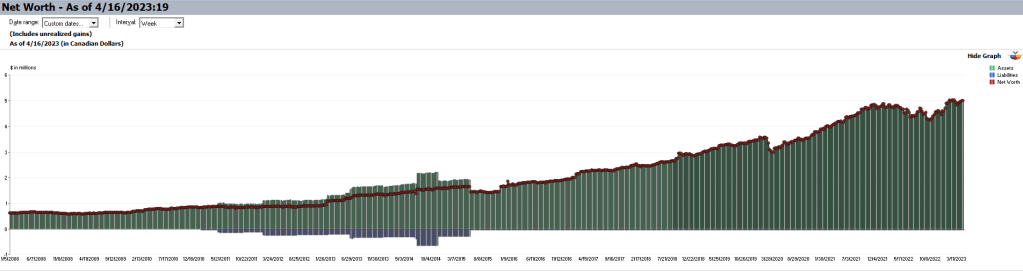

April 16, 2023: As the worries of a new US banking crises went away, the portfolio recovered. We’re still worried about inflation, recession and interest rates. Net worth: 5,023K

To give you a perspective on how the net worth is distributed, below are my trading accounts. In the Property & Debt section, Delectable and Dimpled are two US properties that have had US taxes withheld during their sale, so I am expecting a credit on my taxes.

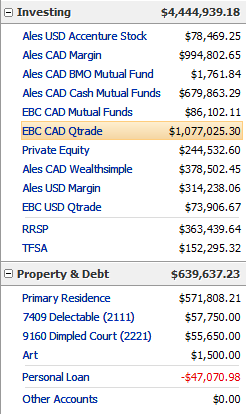

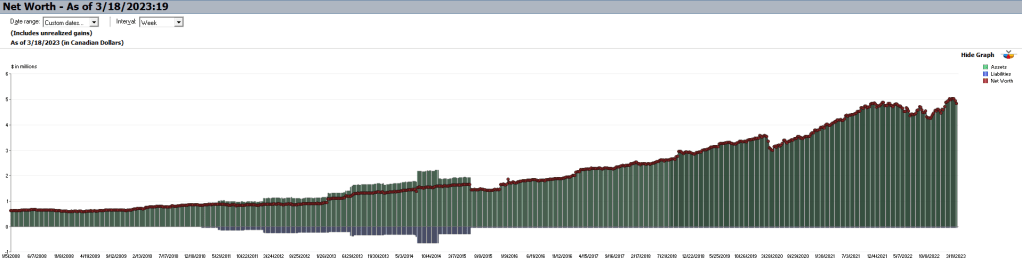

March 18, 2023: The failure of a few US regional banks and Credit Suisse issues have spooked the markets and everything except technology sold off, especially energy and financials. Net worth: 4,867K

To give you a perspective on how the net worth is distributed, below are my trading accounts. In the Property & Debt section, Delectable and Dimpled are two US properties that have had US taxes withheld during their sale, so I am expecting a credit on my taxes.

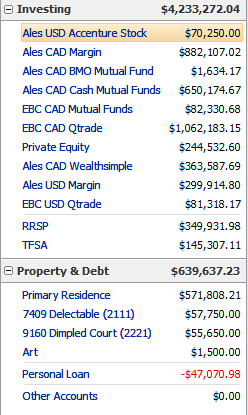

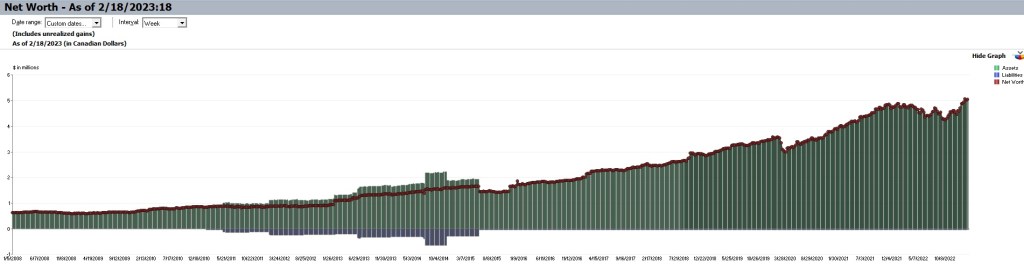

February 18, 2023: There were weeks with small, positive returns in the markets, bringing the net worth up. The quarterly earnings for Q4 of 2022 were generally positive. A new all-time high net worth was reached. Net Worth: 5,081K

January 14, 2023: After several great, upward-trending weeks, my net worth hit a new high. As inflation slows, the central banks look like they will raise rates less, and investors become more optimistic. Net Worth: 4,988K

December 17, 2022: After some volatility and the US Fed continuing to be hawkish and committed to raising interest rates, the markets came off some. Net Worth: 4,685K

November 19, 2022: The stocks and mutual funds continued their recovery, increasing the net worth by 200+K. The sale of one of my US real estate investment properties was for a lower amount than expected, but the strong US dollar improved the results. Net Worth: 4,756K

October 15, 2022: The stock market has returned into bear market territory, causing the net worth to come down a little. Net Worth: 4,571K