The video is a Zoom call recording from January 18, 2024, presenting the information I compiled over a decade about #personalfinance and #investing.

Topics for this session

- Recap of Part 1

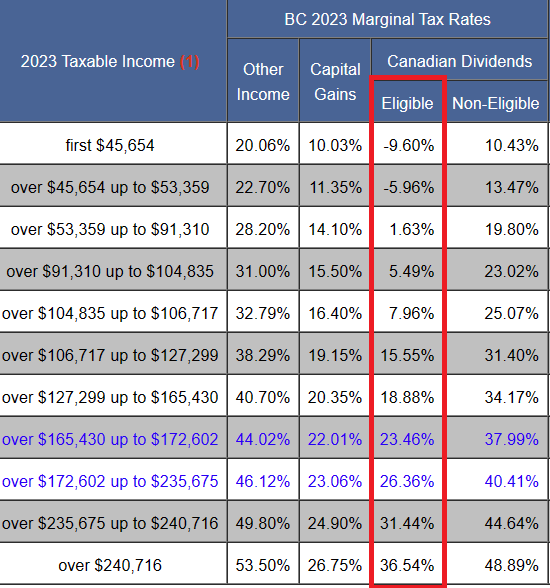

- Taxes

- Personal Finance

The #CanadianMoneyTalk channel concentrates on #Canadianinvesting and #personalfinance in Canada.

Visit: http://www.canadianmoneytalk.ca

The Advanced Investing: Stock Analysis Course is at https://canadianmoneytalk.ca/advanced-investing-stock-analysis-course/

The Investing & Personal Finance Basics course is at https://canadianmoneytalk.ca/investing-personal-finance-basics-course/