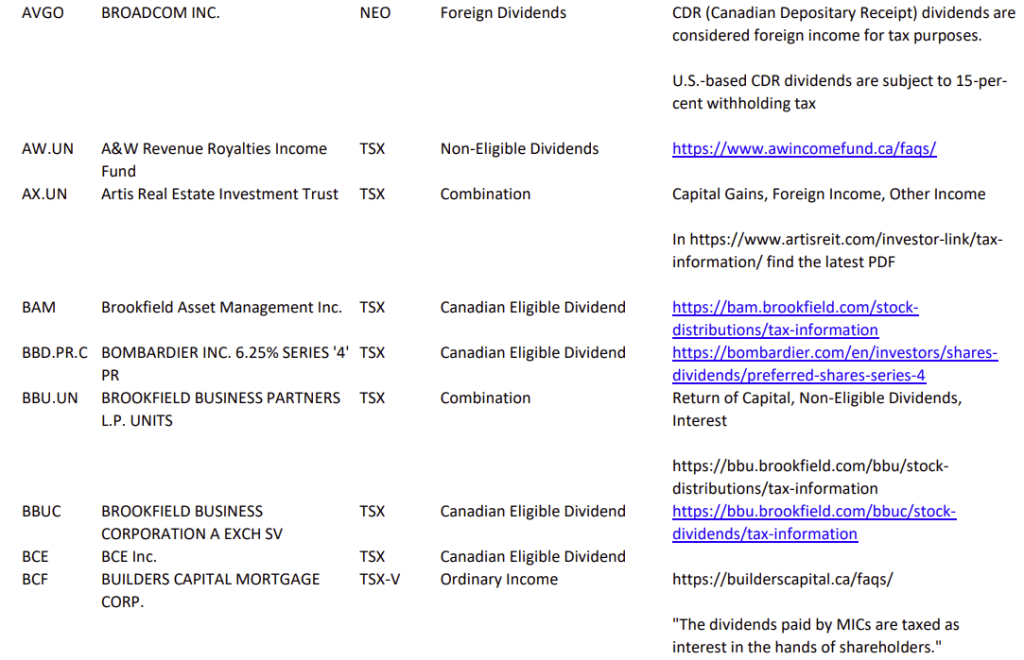

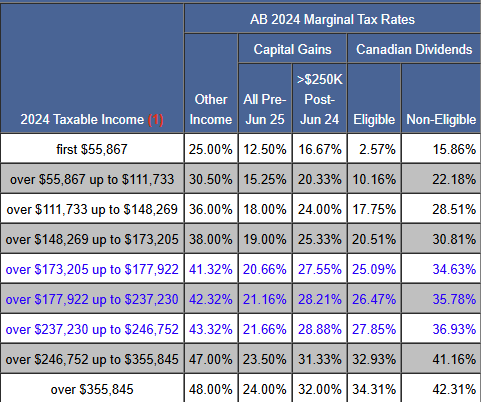

I had a viewer question about #tax #rates on #Canadian vs. #foreign #dividends and which #account #minimizes tax #withholding on foreign dividends (#RRSP vs. #TFSA vs. #non-registered or #cash accounts), as well as the rates at which various #dividend #income is taxed. The video covers the entire Canadian #taxation system for context, and answers the question for tax #efficiency.

The #CanadianMoneyTalk channel concentrates on #Canadianinvesting and #personalfinance in Canada.

Visit: http://www.canadianmoneytalk.ca

The Investing & Personal Finance Basics course is at https://canadianmoneytalk.ca/investing-personal-finance-basics-course/

The Advanced Investing: Stock Analysis Course is at https://canadianmoneytalk.ca/advanced-investing-stock-analysis-course/